Locating a new company or expansion business in Currituck County, North Carolina is not only good for business, it’s smart to save on taxes too.

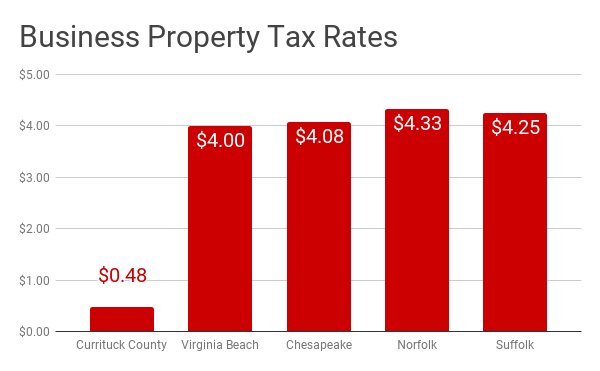

Currituck has one of the lowest local tax burdens in North Carolina and is much lower than our neighboring state of Virginia. And, because Currituck is unincorporated, all business, personal and real property is taxed at the same low rate.

Those are big tax breaks any business can appreciate.

In 2013, the state of North Carolina reformed their tax code with a single income tax rate, an increased standard deduction and fewer tax breaks, as well as the elimination of the personal exemption and a $50,000 deduction for small business owners. It also repealed the state's estate tax. All of this adds up to an appealing financial climate for new or expanding businesses.

With these changes, our tax rates are now lower than those in the Hampton Roads region. In fact, they are much lower. So, businesses can save real money when they locate to Currituck.

All values expressed per $100 of valuation.

All values expressed per $100 of valuation.

In addition to these tax breaks, North Carolina also encourages new and expanding businesses with tax credits and exemptions, facilities development grants and workforce training programs. This coastal right-to-work state also has many pro-business policies such as Job Development Investment grants, which refunds employees withholding taxes and Community Development Block grants for infrastructure costs.

These Stories on Incentives

No Comments Yet

Let us know what you think